Delve into the world of Sustainable Life Coverage with Long-Term Benefits, where insurance meets long-lasting security and peace of mind. This guide will take you on a journey through the intricacies of life coverage plans, highlighting the importance of sustainability and long-term benefits for individuals and families alike.

Explore the key features, types of policies, factors to consider, and strategies for maximizing benefits in this engaging discussion.

Definition and Importance of Sustainable Life Coverage with Long-Term Benefits

When we talk about Sustainable Life Coverage with Long-Term Benefits in the insurance industry, we are referring to insurance plans that not only provide financial protection for individuals and families in the event of unexpected circumstances but also offer benefits that extend over a long period of time, ensuring stability and security for the future.

Significance of Long-Term Benefits in Life Coverage Plans

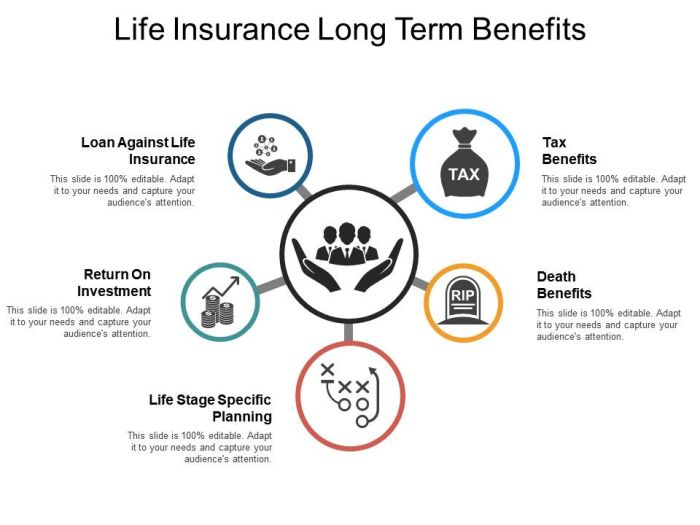

Having long-term benefits in life coverage plans is crucial for individuals and families as it provides:

- Financial Security: Long-term benefits ensure that policyholders have a safety net in place to cover future expenses such as education, mortgage payments, or retirement.

- Stability and Peace of Mind: Knowing that there are long-term benefits associated with their life coverage can give individuals and families peace of mind, knowing that they are protected for the long haul.

- Legacy Planning: Long-term benefits allow policyholders to plan for the future and leave a financial legacy for their loved ones, ensuring that their family is taken care of even after they are gone.

Key Features of Sustainable Life Coverage

When it comes to sustainable life coverage with long-term benefits, there are several key features that set these plans apart from traditional insurance policies. These features not only provide financial protection but also ensure stability and security for policyholders in the long run.

Flexible Premiums and Coverage Options

- One essential feature of sustainable life coverage is the ability to customize premiums and coverage options based on individual needs and financial situations. Policyholders can adjust their premiums and coverage levels as their circumstances change, ensuring that the policy remains relevant and affordable over time.

- This flexibility allows policyholders to adapt their coverage to meet evolving needs, such as starting a family, buying a home, or planning for retirement. By offering a range of options, sustainable life coverage plans can provide long-term benefits by accommodating life changes without the need to purchase new policies.

Guaranteed Cash Value and Accumulation

- Another key feature of sustainable life coverage is the guaranteed cash value and accumulation component. This feature ensures that policyholders receive a cash value that grows over time, providing a valuable source of funds that can be accessed in the future.

- By accumulating cash value, policyholders can enhance their financial security and access funds for emergencies, education expenses, or retirement income. This feature contributes to the long-term benefits of sustainable life coverage by building wealth and providing a safety net for the future.

Living Benefits and Riders

- Sustainable life coverage plans often include living benefits and riders that offer additional protection and flexibility. These features can provide coverage for critical illnesses, disability, or long-term care, allowing policyholders to access funds while they are still alive.

- By incorporating living benefits and riders, sustainable life coverage plans enhance the overall value of the policy and provide peace of mind for policyholders and their families. These features contribute to the long-term benefits of the policy by offering comprehensive protection against unforeseen circumstances.

Types of Sustainable Life Coverage Policies

When looking for life coverage policies that offer long-term benefits, it is important to understand the different types available in the market. Each type of policy comes with its own set of features and benefits that cater to different needs and financial goals.

Term Life Insurance

Term life insurance provides coverage for a specific period of time, usually ranging from 10 to 30 years. This type of policy offers a death benefit to the beneficiaries if the insured passes away during the term. Term life insurance is known for its affordability and simplicity, making it a popular choice for those looking for temporary coverage.

Whole Life Insurance

Whole life insurance is a permanent policy that provides coverage for the entire lifetime of the insured. Along with a death benefit, whole life insurance also accumulates cash value over time, which can be accessed through policy loans or withdrawals.

This type of policy offers guaranteed premiums and a guaranteed death benefit, providing long-term financial security.

Universal Life Insurance

Universal life insurance is another type of permanent policy that offers flexibility in premium payments and death benefits. With universal life insurance, policyholders have the option to adjust their premiums and coverage amounts based on their changing financial needs. This type of policy also accumulates cash value, which can be used to supplement retirement income or cover future expenses.

Variable Life Insurance

Variable life insurance combines the death benefit protection of traditional life insurance with the potential for cash value growth through investment options. Policyholders have the choice to allocate their premiums into different investment accounts, such as stocks or bonds. The cash value of a variable life insurance policy fluctuates based on the performance of the underlying investments, offering the potential for higher returns but also higher risks.

Survivorship Life Insurance

Survivorship life insurance, also known as second-to-die insurance, covers two individuals under one policy and pays out the death benefit after both insured parties have passed away

Factors to Consider When Choosing a Sustainable Life Coverage Plan

When selecting a life coverage plan with long-term benefits, individuals should carefully consider various factors to ensure they choose the most suitable policy that aligns with their needs and goals. These factors can significantly impact the sustainability and benefits of the chosen policy, influencing the financial protection it provides in the long run.

Financial Stability of the Insurance Provider

It is crucial to assess the financial stability of the insurance company offering the life coverage plan. A financially stable insurer is more likely to fulfill its obligations and pay out claims when needed, ensuring the long-term benefits of the policy.

Premium Affordability

Consider the affordability of the premiums associated with the life coverage plan. It is important to choose a policy with premiums that fit within your budget to ensure you can sustain the coverage over the long term without any financial strain.

Coverage and Benefits

Evaluate the coverage and benefits offered by the life insurance policy. Ensure that the policy provides adequate coverage for your needs and offers relevant benefits that align with your goals, such as critical illness coverage, disability benefits, or riders for additional protection.

Policy Flexibility

Look for a life coverage plan that offers flexibility in terms of adjustments and customization. A policy that allows you to modify coverage amounts, add or remove riders, or change premium payment options can better adapt to your changing needs and circumstances over time.

Policy Exclusions and Limitations

Carefully review the exclusions and limitations of the life coverage plan to understand what is not covered by the policy. Being aware of any restrictions can help you avoid surprises in the future and ensure that the policy meets your expectations in terms of coverage.

Customer Service and Reputation

Consider the customer service reputation of the insurance company and how they handle claims and inquiries. Opt for an insurer with a strong reputation for customer service and a history of efficiently processing claims to ensure a smooth experience throughout the policy term.

Strategies for Maximizing Long-Term Benefits in Life Coverage

When it comes to life coverage plans, maximizing long-term benefits is essential for ensuring financial security and peace of mind. Here are some strategies and tips on how policyholders can optimize the long-term benefits of their life coverage plans:

Regularly Review and Update Coverage

One key strategy for maximizing long-term benefits in life coverage is to regularly review and update your coverage. Life circumstances change, and it's important to ensure that your coverage aligns with your current needs and goals. By reviewing and updating your coverage regularly, you can make sure that you have adequate protection for yourself and your loved ones.

Consider Adding Riders

Another way to enhance the long-term benefits of your life coverage is to consider adding riders to your policy. Riders are additional benefits that you can include in your coverage to customize it to better suit your needs. For example, you may consider adding a critical illness rider or a disability income rider to provide extra protection in specific situations.

Choose a Sustainable Policy

Opting for a sustainable life coverage policy is crucial for maximizing long-term benefits. Sustainable policies are designed to provide coverage for the long term, ensuring that you have financial protection throughout your life. Look for policies that offer flexible premium payment options, guaranteed renewability, and cash value accumulation to secure your financial future.

Final Conclusion

In conclusion, Sustainable Life Coverage with Long-Term Benefits offers a robust shield against life's uncertainties, ensuring a stable future for policyholders. By understanding the nuances of sustainable coverage, individuals can make informed decisions to secure lasting benefits for themselves and their loved ones.

Questions Often Asked

What are the benefits of Sustainable Life Coverage with Long-Term Benefits?

Answer: Sustainable life coverage offers long-lasting financial security and peace of mind by providing benefits that extend over time, ensuring protection for policyholders and their families.

How can I choose the right Sustainable Life Coverage plan?

Answer: Consider factors such as coverage duration, premium cost, benefits offered, and the insurer's reputation when selecting a sustainable life coverage plan with long-term benefits.

Are there any tax benefits associated with Sustainable Life Coverage?

Answer: Some life coverage plans offer tax advantages, such as tax-free death benefits or cash value accumulation, making them a valuable financial tool for policyholders.