Exploring the intersection of insurance and the evolving landscape of remote work, Modern Lifestyle Insurance for Remote Workers delves into the unique needs of individuals working outside traditional office settings. As the workforce continues to embrace remote work, the demand for specialized insurance solutions tailored to this lifestyle is on the rise.

Let's uncover the essential aspects of modern lifestyle insurance and how it caters to the specific requirements of remote workers.

Introduction to Modern Lifestyle Insurance for Remote Workers

Modern lifestyle insurance is a specialized type of insurance coverage designed to meet the unique needs of remote workers. As the traditional work landscape evolves, with more individuals opting for remote work opportunities, the demand for tailored insurance solutions has increased significantly.

The Growing Trend of Remote Work

Remote work has become increasingly popular in recent years, with advancements in technology enabling individuals to work from anywhere in the world. This shift in the way we work has highlighted the need for insurance policies that cater to the lifestyle and risks associated with remote work.

Differences from Traditional Insurance Policies

Modern lifestyle insurance differs from traditional policies by offering coverage that specifically addresses the challenges and uncertainties faced by remote workers. This may include coverage for digital assets, liability protection for home offices, and flexible coverage options that can adapt to the changing needs of remote workers.

Types of Insurance Coverage for Remote Workers

Remote workers have unique insurance needs that differ from traditional office-based employees. Let's explore the various types of insurance options tailored specifically for remote workers.

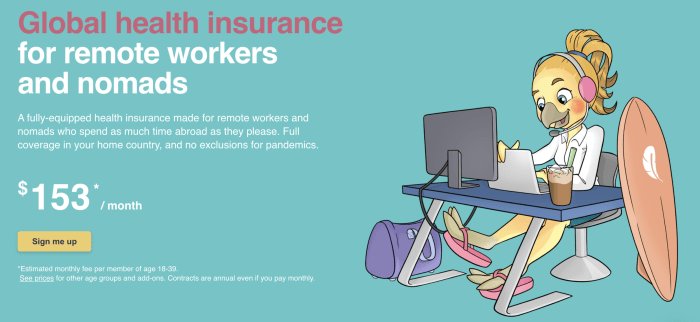

Health Insurance for Remote Workers

Health insurance is crucial for remote workers as it provides coverage for medical expenses, including doctor visits, prescription medications, and hospital stays. With the flexibility of working from anywhere, remote workers may not have access to employer-provided healthcare benefits, making individual health insurance a vital investment.

Cyber Insurance for Remote Workers

In the age of remote work, cyber insurance is becoming increasingly important. Remote workers are more susceptible to cyber threats as they often use personal devices and unsecured networks to perform their job duties. Cyber insurance can help protect remote workers from financial losses due to data breaches, hacking incidents, or other cyber-related risks.

Benefits of Modern Lifestyle Insurance for Remote Workers

Having insurance specifically designed for remote workers comes with a range of advantages that cater to their unique work environment and lifestyle. Modern lifestyle insurance can provide peace of mind and security for remote workers by offering tailored coverage that addresses their specific needs and concerns.

This not only ensures financial protection in case of unexpected events but also enhances the overall well-being and productivity of remote employees.

Customized Coverage Options

- Modern lifestyle insurance for remote workers often includes coverage for digital assets, such as laptops, smartphones, and other essential tools for remote work.

- Flexible policies can be personalized to accommodate the varying work schedules and locations of remote employees, providing comprehensive protection no matter where they are working from.

Health and Wellness Benefits

- Some modern lifestyle insurance plans offer virtual healthcare services, mental health resources, and wellness programs to support the holistic well-being of remote workers.

- Access to telemedicine and online counseling can help remote employees maintain their health and productivity without the need for in-person appointments.

Income Protection and Disability Coverage

- In the event of an injury or illness that prevents remote workers from fulfilling their job duties, modern lifestyle insurance can provide income protection and disability benefits to ensure financial stability during recovery.

- This coverage can alleviate the financial burden of unexpected medical expenses and loss of income, allowing remote workers to focus on their health and well-being without worrying about financial hardships.

Challenges and Considerations

When it comes to modern lifestyle insurance for remote workers, there are specific challenges that insurance providers face in adapting to the evolving needs of this workforce. Additionally, remote workers themselves need to consider various factors when selecting insurance coverage that suits their unique work environment.

Let's delve into the challenges, key considerations, and potential gaps in traditional insurance coverage for remote work scenarios.

Challenges Faced by Insurance Providers

Insurance providers encounter challenges in catering to the needs of remote workers due to the non-traditional work setup. Some of the key challenges include:

- Assessing and underwriting risks for individuals working from diverse locations

- Developing policies that address the specific liabilities associated with remote work

- Ensuring proper communication and support for remote workers in case of claims or inquiries

- Adapting to the changing regulatory landscape regarding remote work arrangements

Key Considerations for Remote Workers

Remote workers need to carefully consider several factors when selecting modern lifestyle insurance to ensure adequate coverage for their unique work setup. Some key considerations include:

- Coverage for home office equipment and technology

- Health insurance options that provide access to virtual healthcare services

- Liability coverage for potential work-related incidents in a non-traditional work environment

- Income protection in case of disability or inability to work remotely

Potential Gaps in Traditional Insurance Coverage

Traditional insurance policies may have gaps when it comes to addressing the specific needs of remote workers. Some potential gaps include:

- Lack of coverage for home office equipment and cybersecurity risks

- Limited coverage for work-related injuries or accidents outside a traditional office setting

- Inadequate provisions for income loss due to disruptions in remote work arrangements

- Exclusions related to remote work activities that may not be covered under standard policies

Final Conclusion

In conclusion, Modern Lifestyle Insurance for Remote Workers offers a comprehensive approach to addressing the insurance needs of individuals navigating the remote work environment. By providing tailored coverage and enhancing peace of mind, this type of insurance not only safeguards remote workers but also contributes to their overall well-being and productivity.

As remote work becomes increasingly prevalent, the significance of modern lifestyle insurance cannot be understated in ensuring a secure and protected work experience.

FAQ

What does modern lifestyle insurance entail?

Modern lifestyle insurance encompasses specialized coverage tailored to the unique needs of remote workers, offering protection in areas like health, cyber threats, and other aspects relevant to the remote work environment.

How does modern lifestyle insurance differ from traditional insurance policies?

Unlike traditional insurance policies, modern lifestyle insurance is designed to address the specific challenges and risks faced by remote workers, providing customized coverage that aligns with the demands of remote work.

Why is cyber insurance important for remote workers?

Cyber insurance is crucial for remote workers as it helps protect against cyber threats and data breaches that are increasingly prevalent in the digital age, ensuring the security of sensitive information and valuable data.

![Smart Life Insurance Reviews For 2025 [Compare Best Quotes] Smart Life Insurance Reviews For 2025 [Compare Best Quotes]](https://lifestyle.viralsumsel.com/wp-content/uploads/2025/06/453315dc65ca4c973594a4e273616ed0-300x178.jpg)